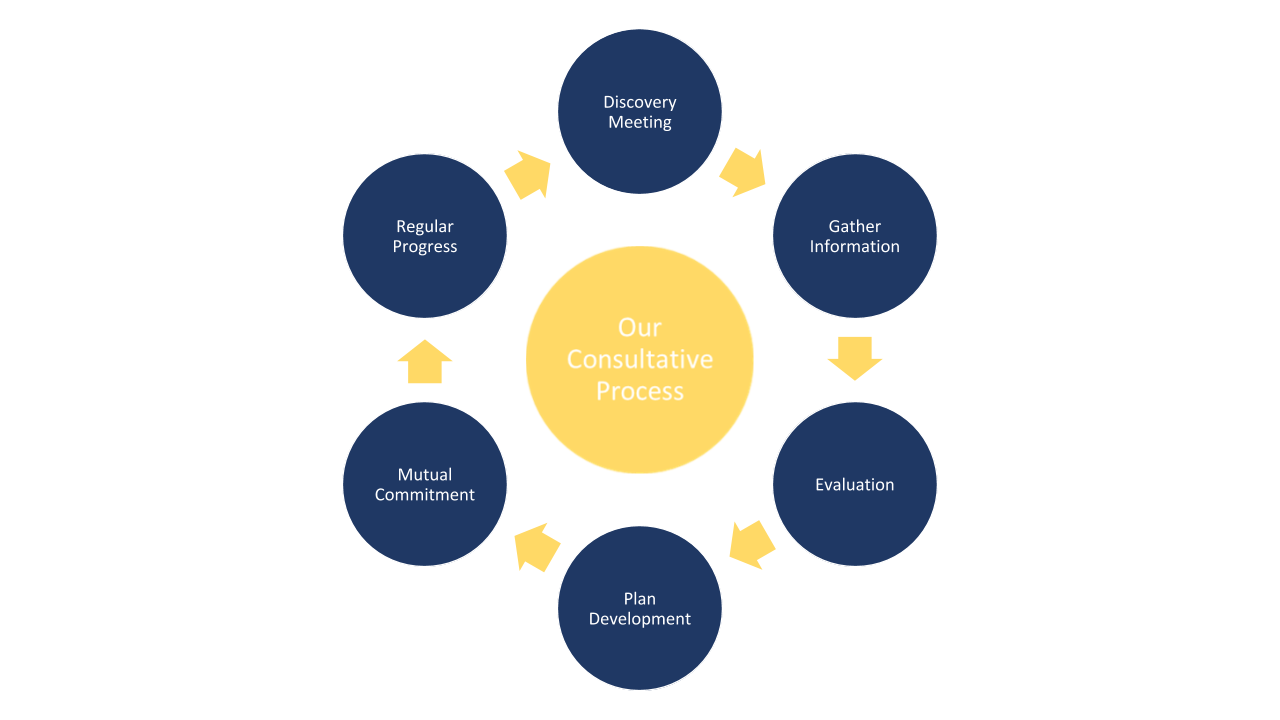

A thorough, structured planning process is the best way to create a more financially secure plan. That said, it remains important to follow an individualized, unbiased approach with each of our clients.

Our team does this by following a six-step process.

Step 1 Discovery Meeting

It’s vital for us to connect with our clients and to understand their current financial situation, and what their financial goals and needs for the future look like.

Step 2: Gathering your information

Once we have determined your situation and goals and you are comfortable to proceed with our recommendations, we will gather all the required information to draw up a customized financial plan that tailors for your individual needs.

Step 3: Evaluating your information

We will do an in-depth evaluation of the information we gathered to determine the strengths and weaknesses of your current financial situation, and what will be required to meet your long-term objectives.

Step 4: Developing your plan

The first three steps of our method enables us to draw up a customized financial plan to help you achieve your financial goals. This will be an opportunity to discuss, debate and resolve any of your concerns – ensuring you understand, and are comfortable with your plan before we proceed with its implementation.

Step 5: Mutual commitment

Following an impartial approach, we will identify and present you with hand-picked solutions that we believe will suit your individual needs, and ensure you understand how these products and services will help you to meet your financial objectives.

Step 6: Reviewing your progress

Thanks to regular and thorough monitoring of our clients’ accounts, we will provide you with regular feedback to give you peace of mind that your financial plan is on track. And because we always factor in flexibility into our plans, our interactions also provide you – and us – the ability to determine if your financial plan requires any adjustments as a result of changes in your family, home, work or living situation.